Direct and Indirect Costs Accounting for Managers

31 prosinca, 2020

It is important to look at the purpose of the individual project. What may be considered a normal direct cost for one project may not be reasonable for another. Generally, a business wants to see a lower number for their overhead rate. This means that they are making enough money to cover their overhead costs. Participant support costs were traditionally allowed only by certain federal agencies or funding announcements. Under the Uniform Guidance, these costs are allowed with prior written approval of the funding agency, provided they are programmatically justified.

- A business exposes itself to external issues, such as market shocks or disruptions, that may affect its operational efficiency.

- Being able to understand the difference between the two different types of costs will not only help you improve your margins but will give you a better estimate of your project spend.

- Sakshi Udavant covers small business finance, entrepreneurship, and startup topics for The Balance.

- For example, clerical assistants who help maintain the office support the company as a whole instead of just one product line.

- But production costs go beyond the materials and equipment — you also need to factor in workers’ salaries, marketing campaigns, overall company maintenance, and the like.

- Both direct and indirect costs have an effect on your net income, but for very different reasons.

Please note that we are listing every expense and not yet thinking in terms of direct and indirect costs. These costs are allocated to sponsored projects in accordance with OMB circulars through the application of the university’s federally approved indirect costs rate. Both direct cost and indirect cost can either be fixed or variable. Indirect labor costs make the production of cost objects possible, but aren’t assigned to a specific product. For example, clerical assistants who help maintain the office support the company as a whole instead of just one product line.

Direct Costs & Indirect Costs: Complete Guide [+ Examples]

You won’t be producing the same amount of a product at all times. This means that the production costs and material costs will vary depending on the need. For cost controlling purposes, many companies try to limit their indirect costs as a proportion of direct costs. Because creating more units requires more materials and resources.

“The total of all your sales must cover direct and indirect costs for your company to make a profit. That means some products must be priced above their direct costs to cover indirect costs,” Rob Stephens, a financial consultant advising small businesses, told The Balance via email. As an example, we can say that direct costs are the expenses incurred for the raw materials used in the production process. Since one can directly attribute how much cost is expended per unit of raw material, we call it direct cost.

Direct Costs and Indirect Costs (F&A) Defined

The direct cost can be identified easily as per the cost object. Salary of a production supervisor who oversees the full manufacturing process of a company’s entire product line encompassing many different products. The manager’s salary does not change based on how much https://quick-bookkeeping.net/see-whats-new-with-estimates-and-invoices-in/ product the factory makes and sells. Although most direct costs tend to be variable, there are exceptions to the rule and some direct costs may be considered fixed. Directly and easily attributable to a single one specific cost object without the need for allocation.

Hourly-paid employees or contractors working in administrative roles (e.g., accounting, legal, IT) who need to work more hours during the busy season (e.g., Christmas). SG&A, which stands for other selling, general and administrative expenses. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

What are Direct vs. Indirect Costs?

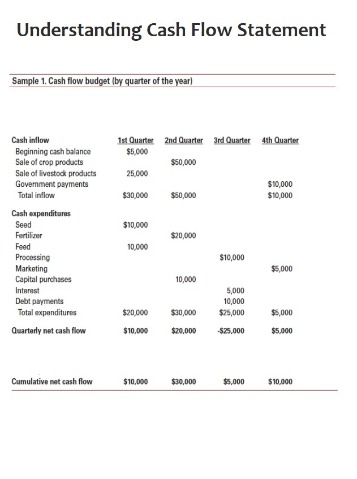

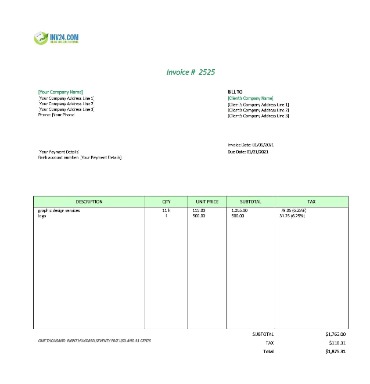

Below is an example of direct & indirect costs appearing on a manufacturing company’s income statement. Indirect costs include utilities, consulting, legal and financial fees, administrative expenses, maintenance expenses, phone, internet, rent, insurance, etc. Direct costs include labor, raw materials, consumables, staff salaries, fuel, etc.

Let’s say you make rent and utility payments to keep your business going. These costs are not directly related to producing a specific product or performing a service, so they are indirect costs. Indirectly, they help you produce goods and perform services, but you can’t directly apply them to a specific product or service. It’s important to know the difference between the types of costs because it gives you a greater understanding of your product or service, thus leading to more competitive pricing.

On April 10, Shandra White will join the University of Michigan to lead its Office of Research and Sponsored Projects as assistant vice president for research and sponsored projects. Payroll taxes are shown as being entirely allocated to the indirect category. There are some companies that allocate some of these to the direct column, but we will keep this example as simple as possible. Are costs that cannot be conveniently and economically identified with cost objectives and must be allocated—on some equitable basis—to the cost objectives or segments under consideration. Clarke Beller is an Audit Director at Lutz with over 11 years of experience. He specializes in providing auditing and consulting services to privately held companies and employee benefit plans with a focus on the construction industry.

A direct cost can be traced to the cost object, which can be a service, product, or department. Direct and indirect costs are the two major types of expenses or costs that companies can incur. Direct costs are often variable costs, meaning they fluctuate with production levels such as inventory. However, some costs, such as indirect costs are more difficult to assign to a specific product. Examples of indirect costs include depreciation and administrative expenses. Indirect costs are costs that are not directly related to a specific cost object like a function, product or department.

By contrast, the manager will not have control over the portion of indirect costs. A new project manager at your construction company is consistently seeing margins deteriorate at the end of their construction projects. The key question when confronting this situation is to determine if project management and accounting know and understand their costs.

When recording direct costs, in most instances, these costs will be variable, meaning that they can change according to production levels. If your production ramps up in the summer, it’s likely that your materials costs and labor costs will increase as well. Both direct and indirect costs have an effect on your net income, but for very different reasons.

Maintaining timely records and being sure to include all costs during the entire project will help you avoid any potential errors. Additionally, the business loses control over the production Direct Vs Indirect Costs processes, which might affect the quality. A business exposes itself to external issues, such as market shocks or disruptions, that may affect its operational efficiency.

- Not allocating indirect costs on a timely basis (i.e. annually instead of monthly).

- The easiest way to tell the difference between direct and indirect costs is by determining whether the cost is specific to a product.

- Keeping track of your direct and indirect costs is essential when applying for government grants, investor funding, or loans from financial institutions.

- Typically, an employee’s wages do not increase or decrease in direct relation to the number of products produced.

- Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

By collecting indirect costs from sponsors, UL Lafayette is recovering those expenses. The federal government has established what costs may be charged as direct costs and what costs are considered included in indirect costs. The following summary gives a brief description of costs and whether they should be charged as direct or whether they are included in the indirect cost calculations. This list is only a summary; a comprehensive list can be found at the Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Awards issued by the Office of Management and Budget.