Control your Budgets using Encumbrance Accounting in Oracle

6 travnja, 2021Content

This allows organizations to determine the amount of funds available for future spending. As a result, they’re able to avoid exceeding the allocated budgets and minimize overspending. Budgetary control involves additional processes such as validating transactions to determine whether spending is permissible or whether sufficient funds are available. Encumbrance accounting is only concerned with creating encumbrance journal entries for documents such as purchase requisitions and purchase orders.

- Encumbrances are important in determining how much funds are available as a projected expense planning tool.

- By making visible the amount of money you plan on spending in the future, you can more accurately see how much money you can spend on future projects or purchases without going over budget.

- For Purchase Order and Travel Authorization encumbrances, when the vendor or employee is paid, part or all of the encumbrance is released in accordance with that payment.

- It allows government entities, nonprofits, and some businesses to more effectively monitor and control how much they spend.

- The amount is set aside by recording a reserve for encumbrance account in the general ledger.

- Overall, it can assist in making purchasing information more transparent and easily accessible when needed to enable tracking and overspending prevention.

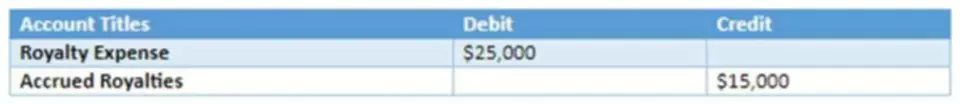

encumbrance accounting are used to track the estimated liabilities and expenditures of a company in order to maintain accurate financial records. The entries record any commitments that have been made but not yet paid for, such as contractual obligations and purchase orders. By tracking these expenses, it helps ensure that the company does not exceed its budget and reduces the chances of fraud or errors. Encumbrance Accounting Journal Entries also make it easier for companies to adhere to legal regulations relating to financial reporting and auditing. With encumbrance accounting, future payment obligations are recorded in financial documents as projected expenses.

What is Encumbrance Funds? and where is it used?

This results in a credit of the invoice amount to the encumbrance account, reducing its balance. Once the invoice is received from the vendor, it should be verified against the transaction created by the Receive Purchase Order process. This will allow you to review the purchase order number the invoice was created from (From PO# field). This will also allow you to add any freight and sales tax amounts that were not known at the time of the receipt.

- This is done before creating and collecting the underlying documents, such as purchase requisitions and purchase orders.

- This type of accounting also helps detect fraud, prevent rampant spending, and increases budget control.

- This encumbrance is later converted to expenditures when goods or services are subsequently procured.

- Encumbrances are given to funds that have been reserved when a purchase requisition is finalized (encumbered).

- To illustrate how the complete encumbrance accounting process works, let’s take a typical example of an encumbrance transaction — a purchase order.

- You may view a budget’s total amount of encumbrances in Grant Tracker.

Money from the encumbrance account is moved into the appropriate account to pay the invoice, and accounts payable handles the vendor payment. The main currency used by the organization to conduct its operations is used when encumbering the items. In the second step, the items are unencumbered once they’ve been transferred to accounts payable. Once the vendor approves the transaction, the commitment converts into a legal obligation.

Phase 2: Encumbrance (Obligation)

We also allow you to process your invoices and payments your way, whether that means email, scanning, or automatically forwarding bills from your email. Routable wants to enable you to grow into the future, which is why we have a sophisticated https://www.bookstime.com/articles/total-manufacturing-cost API for any bulk processing. When you record encumbrance within your ledger, it makes budget data much more accessible. By tracking this information, financial analysis is easier to perform and a more accurate predictor.

- With Encumbrances, no payments leave the University and no actual expense would be generated on a ledger, since it is an expectation of a future actual transaction.

- After that, you unencumber the line items once they go into an Accounts Payable invoice for payment.

- Once a vendor is paid, the encumbrance is lifted and the funds appear in the actual funds balance rather than the encumbrance balance.

- Encumbrances are also known as pre-expenditures since they act as budgeted reserve funds before the actual expenditure.

- The Comptroller’s office automatically lapses all unobligated balances as early as Nov. 1 each year.

- It is difficult to transfer an encumbered property, so the property owner has a strong incentive to settle the underlying claim.

The External Encumbrance (balance type code EX) refers to the commitment of funds generated by purchase orders. When you need to allot money for a future payment, such as when a purchase order is approved, the encumbrance account is debited. In the future, when you pay that sum off, the encumbrance account is credited. The accounting term encumbrance can sometimes be mistaken for real estate encumbrance. When a real estate property has a lien or easement, it is considered encumbered. The real estate term has nothing to do with encumbrance entries in accounting.

Encumbrances

Organizations use budgetary controls to minimize maverick spending and avoid overspending. It allows government entities, nonprofits, and some businesses to more effectively monitor and control how much they spend. They’re better able to keep their expenditures within the allocated budget and more accurately predict cash flow. Encumbrance journal entries and accounting are also sometimes called commitment accounting. This naming makes more sense when you realize that encumbrance enables budgetary control by recording money that is allocated for future projects, preventing over-expenditure of a budget.

- All unobligated appropriation balances must be lapsed by processing a budget lapse transaction into USAS.

- One of the most common examples of an encumbrance is the money allotted when you create a purchase order for services or items from a vendor.

- It is up to your company to decide which items will be the most helpful for them to track to more accurately predict and track cash flow.

- Since the money that the company will spend later is tracked, a company can keep from overspending.